For now, with startup creation and funding in full swing, we can barely keep track of all new IoT startups appearing on the market. Certain areas, particularly on the consumer IoT side (most blatantly, wearables, fitness and home automation) are now overcrowded, inevitably raising the specter of failure and forced consolidation. The enterprise and industrial sides of the Internet of Things are more open, bearing in mind that some existing players in those spaces have been operating for decades.

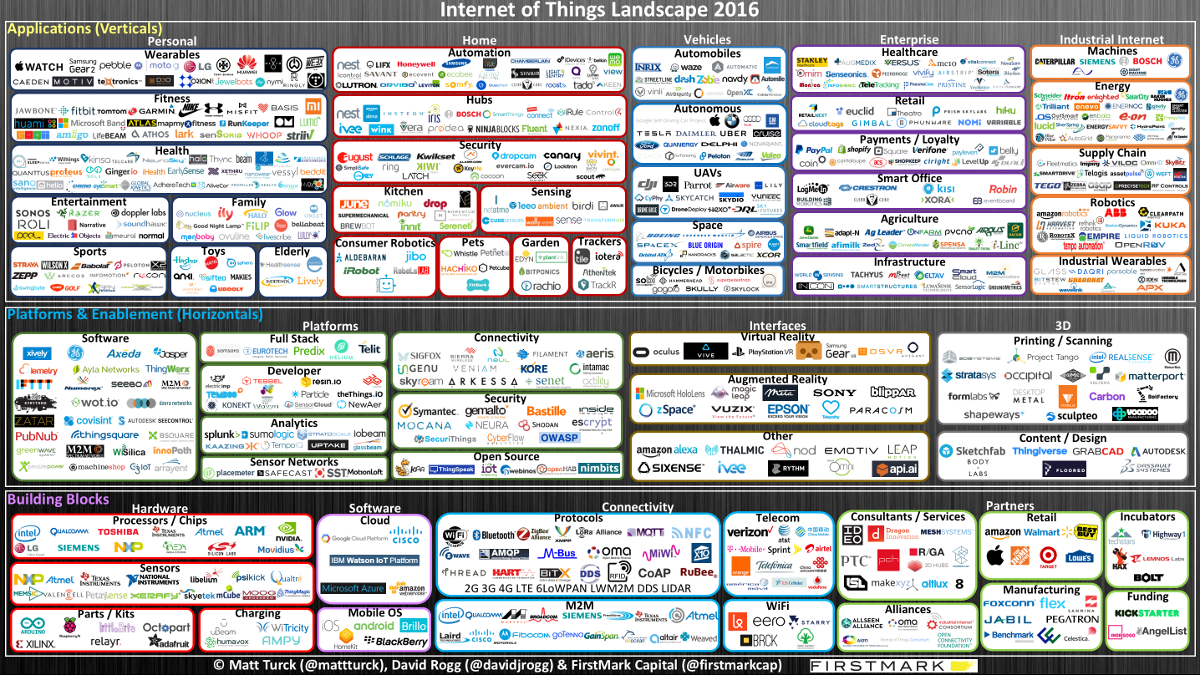

Here’s our 2016 landscape:

As in previous versions, the chart is organized into building blocks, horizontals and verticals. Pretty much every segment is seeing a lot of activity, but it is worth noting that those parts are not particularly well integrated just yet, meaning in particular that vertical applications are not necessarily built on top of horizontals. To the contrary, we’re very much very much in the era of the “full stack” IoT startup – because there is no dominant horizontal platform, and not enough mature, cheap and fully reliable components just yet, startups tend to build a lot themselves: hardware, software, data/analytics, etc. Some enterprise IoT companies, such as our portfolio company Helium, also have a professional services organization on top, as enterprise customers are at the stage where they try to make sense of the IoT opportunity and are looking for something that “just works”, as opposed to mixing and matching best of breed components. This is a typical characteristic of startups operating in an early market, and I would expect many of those companies to evolve over time, and possibly ditch the hardware component of their business entirely.

Dancing with the giants

To fully make sense the IoT ecosystem, it’s important to fully realize that large corporations are omnipresent in it. I mentioned this in an earlier post about home automation, but a glance through the 2016 IoT landscape will quickly establish that they are active in pretty much every single category.

In the Internet era (90s and 00s), the dynamic was brutal but pretty simple (at least in retrospect) – on one side, there were the disruptors (Internet-native startups with no legacy); on the other side there were the disrupted (bricks and mortars and other large incumbents paralyzed by the innovator’s dilemma). In the IoT era, things are a little trickier – some of the startups of the Internet era have grown up to be large companies themselves, for example, and it is less clear who is best equipped to disrupt who.

Large public tech and telecom companies have been all over the IoT, which they rightly regard as something that will truly move the needle for them over the next few years and possibly decades. It is entirely possible that, in some cases, announcements are ahead of reality, but nonetheless the trend is clear. Chipmakers (Intel, Qualcomm, ARM) are racing to dominate the IoT chip market. Cisco has been incredibly vocal about the “Internet of Everything” and walked the talk with the $1.4bn Jasper acquisition a few weeks ago. IBM announced a $3 billion investment in a new IoT business unit. AT&T has been aggressive in being the connectivity layer for cars, partnering with 8 out 10 top US car manufacturers. Many telecom companies view their upcoming 5G networks as the backbone of the IoT. Apple, Microsoft and Samsung have been very active across the ecosystem, offering both hubs/platforms (Homekit for Apple, SmartThings and an upcoming OS for Samsung, and Azure IoT for Microsoft) and end products (Apple Watch for Apple, Gear VR and plenty of connected appliances for Samsung and the upcoming HoloLens AR headset for Microsoft). Salesforce announced an IoT cloud a few months ago. The list goes on and on.

Alphabet/Google and Amazon are probably worth mentioning separately because of the magnitude of their potential impact. From Nest (home) to SideWalk Labs (smart cities) to autonomous cars to the Google Cloud, Alphabet already covers huge portions of the ecosystem, and has invested billions in it. On Amazon’s end, AWS seems to be an ever increasing force that keeps innovating and launching new products, including a new IoT platform this year which it inevitably push aggressively to become the backend for the IoT; in addition, the company’s eCommerce operations are increasingly important to IoT products distribution, and Echo/Alexa is turning out to be a major sleeper hit for the company in the home automation world. Both Alphabet and Amazon very much move at the speed of the startups they were not so long ago, sit on immense amounts of user data, and have limitless access to top talent.

Outside the technology world, many “traditional” corporate giants (industrial, manufacturing, insurance, energy, etc.) have both a lot to gain and lot to fear from the Internet of Things. This is a perhaps unprecedented opportunity to rethink just about everything. The IoT will essentially enable (or perhaps, force) large companies to evolve from a product-centric model to a service-centric model. In an IoT-enabled world, large companies will have direct knowledge about how their customers actually use their products; they will be able to market and customize their offerings to a variety of needs (through the software); they will be able to predict when the product will fail and may need support; and they’ll have an opportunity to charge customers by usage (as opposed to a one-time purchase cost), opening the door to subscription models and direct long-term relationships with customers. The impact of those changes on supply chain and retail is likely to be enormous. On the other hand, the threat is immense – what happens to the car industry, for example, as autonomous vehicles become a reality powered by software developed by Google, Apple, Baidu or Uber? Will they be relegated to the status of part maker?

The opportunity to thrive in an IoT world hinges largely on those companies’ ability to gradually evolve into software companies, an immensely difficult cultural and organizational transformation. Some traditional industry companies already have software arms – see Bosch Software Innovations for example or this piece about how General Electric recruited hundreds of software developers in its new Silicon Valley tech offices – so this is not an impossible task, but many companies will struggle immensely to do so.

What does this all mean for startups? Of course, the interest from large companies opens the door to all sorts of acquisition opportunities, both small and large, and sometimes for amounts that are largely disconnected from existing traction (see Nest, Oculus or Cruise) – large tech companies have already demonstrated their acquisition appetite, and large traditional companies will most likely need to acquire their way into becoming software companies. On the other hand, for new startups intending to stay the course and become large independent companies, the path will occasionally be fairly narrow and will require astute maneuvering. Larger companies (e.g. Alphabet/Nest) will certainly not build every single connected product (e.g., every home automation device), but at the same time they will likely preempt the larger opportunities in the space (e.g. being the home automation platform). Or occasionally they will be incredibly aggressive in pursuing the best talent in the market – let’s remember how a few months ago, Uber poached 40 robotics researchers from Carnegie Mellon to help fuel its self-driving technology ambitions. For young startups, the successful strategy will probably involve a combination of finding the right tip of the spear away from the more crowded areas of the market, and partnering with the right large corporate giants to have access to their manufacturing and distribution networks.

Conclusion

The Internet of Things is coming. Obstacles abound, but as our landscape shows, there is an immense amount of activity happening worldwide from both startups and large companies that make this conclusion all but inevitable. Progress may seem slow in some ways, but in fact it is happening remarkably quickly when one pauses to think about the magnitude of the change a fully connected world requires. What seemed like complete science fiction 10 years ago is in the process of becoming reality, and we are getting very close to being surrounded by connected objects, drones and autonomous cars. The bigger question might be whether we are ready as a society for this level of change.

No comments:

Post a Comment