Nine geospatial technology trends that could define 2017

We are on the cusp of a fourth industrial revolution. That was the big buzz at the World Economic Forum in Davos in 2016. Now before we get into what the fourth industrial revolution entails, let’s quickly take a look at the first three.

First industrial revolution: The first industrial revolution began in Britain in late 18th century, with the mechanization of the textile industry. Tasks previously done laboriously by hand in hundreds of weavers’ cottages were brought together in a single cotton mill, and the factory was born.

Second Industrial Revolution: Also known as the Technological Revolution, was a phase of rapid industrialization in the end of the 19th and beginning of the 20th century, when Henry Ford mastered the moving assembly line and ushered in the age of mass production.

Third industrial revolution: Beginning 1970s, this was digital and entailed the proliferation of computers and applied electronics and information technology to processes of production. Mass customization and additive manufacturing are its key concepts.

And even as we were talking about the third industrial revolution as late as 2013 and how new advancements in a digital revolution, the fourth is already upon us.

So what is the Fourth Industrial Revolution?

“A technological revolution that will fundamentally alter the way we live, work and relate to one another,” is how Klaus Schwab, Founder and Executive Chairman of WEF, describes it.

New technologies and innovations are merging the physical, digital and biological worlds in ways that will fundamentally transform humankind. It is said the fourth industrial revolution builds on top of the third, and this global revolution will affect all countries and have a systems-level impact in many areas.

So what’s in it for geospatial?

A field like geospatial is always difficult to predict given its constant evolution and how fast it is getting integrated in other technologies. The Year 2016 was one of transformation. As new technologies and location became more and more fundamental to all processes, a number of new, path-breaking concepts took center stage. There are some definite trends that have evolved very fast and will surely go on to define the tech landscape not only in 2017, but also the next few years to come.

1. Map is a toothbrush

For the uninitiated, Google has a benchmark for all technologies they work on — the Toothbrush Test that every product must pass. You use your toothbrush every day; you don’t think about it as it as part of your day-to-day life. We are almost there with maps now. It’s all-pervasive. We use it for navigating on roads, hailing a cab, checking on traffic, locating the nearest pizza store… it is impossible to think of undertaking an activity that doesn’t involve mapping or location.

Besides, we are also witnessing an exponential growth in both the number of data capture methods and, perhaps more significantly, in the amount of data being generated and captured. This “massificiation” of maps will lead to many more advancements and products around the location sphere.

2. Spatial & biz analytics

Maps are not just driving your cars. They are driving economies too. While the location theory in economics is quiet old, going as far back as the 19th century, when Johann Heinrich von Thünen‘s first volume of Der Isolierte Staat came out in 1826, it is only now that spatial analysis is increasingly being taken seriously around the world to derive new information and make informed decisions. Location theory addresses questions of what economic activities are located where and why, and has become an integral part of economic geography, regional science, and spatial economics.

Organizations that use spatial analysis in their work are wide-ranging—local and state governments, national agencies, businesses of all hues, utility companies, colleges and universities, NGO. Creating interactive maps inside existing business systems can help users see patterns that graphs and charts cannot reveal.

Here are just a few examples.

3. Location-based services

Location-based services, what is popularly known as LBS, refer to the delivery of services to users or machines using real-time location data in conjunction with other contextually relevant information. There are two major trends which is driving LBS uptake: smartphone adoption; and quick sharing capability of hyper-local information.

Location-based services can be roughly segmented into four categories: LBS search and advertising; LBS tracking; LBS navigation; and LBS infotainment, analytics, recreation and fitness. Some of the prominent vendors for the LBS market space include Apple, HERE, Micello and Telenav. Even social apps are beginning to incorporate a wide range of capabilities beyond their core function as peer-to-peer communications tools. In terms of social applications using mobile location data to target users, Facebook, Twitter, Instagram, WeChat and Sina Weibo are among the top players. These apps are transforming into platforms themselves, offering even more data for ad campaigners. For instance, Facebook Messenger is partnering with Uber to deliver ride hiring services, or Pinterest developing tools that serve to reduce the intrusiveness of advertisements. With rapid Bluetooth beacon deployments, improved Wi-Fi services, and the re-emergence of ultra-wide band, the next wave of location-based services is upon us.

4. Artificial Intelligence

Artificial intelligence (AI) no doubt has emerged as the single biggest disruptive technology in the recent times. This can be further substantiated by the fact that all IT majors are currently working on “cognitive computing”, or what has been historically known as ‘artificial intelligence’.

In addition to high investments and top-level appointments, last year we saw Google, Microsoft, Facebook, Amazon, DeepMind and IBM joining hands to create a non-profit organization (Partnership on AI)that will work to advance public understanding of artificial intelligence technologies and formulate best practices on the challenges and opportunities within the field.

AI & geospatial

The biggest opportunity for geospatial industry in AI is its core asset, which is geospatial data. It is widely acknowledged that 80% of all data that is generated are spatial in nature. So exploiting that data using automation through AI and deep learning comes naturally to creating solutions for rest of the basic sectors. There is another area when we talk of AI – how geospatial companies themselves use AI to sort out the humongous amount of data they generate and extract meaningful information out of it.

Major use areas:

Retail and e-commerce: Big users: Flipkart, Alibaba, Amazon, Walmart Uses: customer identification, engagement, enhanced user experience.

BFSI: The financial sector uses AI to detect potential fraud, streamline back office operations, and assist in stocks and properties management.

Health care: Apart from aiding clinical diagnosis it also is used in medical image interpretation and interpretation of sound patterns like heartbeats.

Heavy industries: Robotics and automation process are a major user of artificial intelligence for efficient work processes and safety.

Smart mobility: Self-driving intelligent trucks and cars. Integrated with IoT, such solutions are poised to bring a paradigm shift in the world of transportation.

Disaster management and military operations: These sectors need almost real-time data analysis are some of other fields where opportunities are immense.

Concerns around AI

If there are plus points, there are some big concerns too. From Stephen Hawking to Elon Musk to Bill Gates, have openly voiced their apprehensions on the nearly boundless landscape of artificial intelligence. In many ways, this is just as much a new frontier for ethics and risk assessment as it is for emerging technology. So which issues and conversations keep AI experts up at night? World Economic Forum compiled a list:

Unemployment: What happens after the end of jobs?

Inequality: How do we distribute the wealth created by machines?

Humanity: How do machines affect our behavior and interaction?

Artificial stupidity: How can we guard against mistakes?

Good vs evil: How do we protect against unintended consequences?

Security: How do we keep AI safe from adversaries?

Reasons for quick uptake of AI would be old and ageing population across the world. In places like India, population may be young but 70% are not educated. A Forrester survey among US companies predict that 8.9 million news jobs will be created by AI in US alone. 16% of US jobs will replaced by AI and 9% of equivalent jobs will be created.

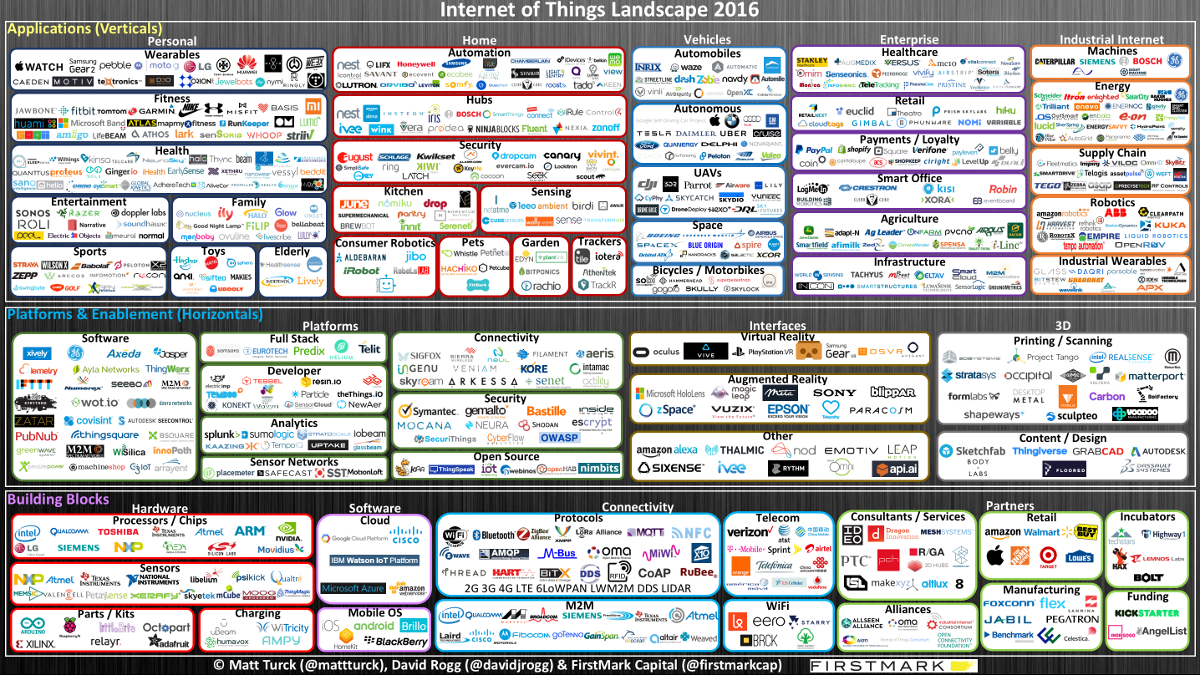

5. Internet of Everything

Internet of Things (IoT) was yesterday. Today, the future is Internet of Everything. IoT is the inter-networking of physical devices, vehicles, buildings, and other items — embedded with electronics, software, sensors, actuators, and network connectivity that enable them to collect and exchange data.

Big Data, Cloud and the Internet of Things are all parts of a continuum. It is hard to think about the Internet of Things without thinking about the Cloud, and it is hard to think about the Cloud without thinking about the analytics.

Multiple sensors like cameras, scanners and sensors will provide data to smart systems in every sphere of life — from cities to energy, transport, agriculture, natural resource management to health etc. So your fridge would be able to tell you it is out of milk. As you drive your car in and out of the driveway, smart lighting control will automatically turn the lights on and off to save on energy costs. Window shades will also automatically open and close based on the weather. In industries, data usage from parts would be able to predict machine breakdown, ordering a replacement automatically before a part actually breaks. Emergency services personnel will know who is in the building and where they are. In the healthcare segment, a patient’s behavior and symptoms could be monitored in real time and at relatively low costs.

Hype is in full swing

Cynics would call it hype. But if we go by figures, the hype is in full swing. Cisco says as many as 50 billion devices will be connected to the Internet by 2020. According to Juniper Research, there will be over 285% rise in connected devices by 2020. IoT industry is set to grow to $1.9 trillion in size by 2020, as per Gartner estimates while A.T. Kearney says IoT will start to impact close to 6% of the global economy in the next four years.

Needless to say this kind of next-generation market opportunity is pulling in tens of millions in venture funding for startups as well. In 2014 alone, over $1.6 billion was invested into IoT companies by venture capitalists.

6. MR, AR & VR

Till about a year back, there was BIM and 3D. Now we are talking about mixed reality, augmented reality and virtual reality. Though often used together and often used interchangeably, there is fundamental difference between AR, VR and MR.

Augmented Reality: AR supplements your world with digital objects of any sort. Augmented reality headsets overlay data, 3D objects and video into your vision in some way or another. All this while continuing to let you see the world around you. Eg: Google’s Glass was AR.

To help field personnel quickly access 3D BIM models and other project documents, general contractor McCarthy Building Companies placed hundreds of QR codes throughout the Oakland Medical Center Replacement Project complex. Users simply scan one of the QR codes with a smartphone or tablet computer and instantly immerse themselves in the up-to-date, as-built 3D BIM model or 3D laser scan of that space.

Virtual Reality: Virtual reality replaces your world with a virtual one. They each involve looking into a headset with lenses that look at a virtual screen. VR makes you completely immersed in another world and blocks everything else. Eg: Oculus Rift, HTC Vive, PlayStation, Gear VR.

Mixed Reality: Mixed reality integrates digital objects into your world making it look as if they are really there. Mixed reality is a mix of real word and virtual world. It is somewhere between AR and VR. Eg: Microsoft Hololens.

Together they are being hailed as the next big thing in the geospatial industry. So how can they help?

In addition to city planning and engineering — where you are constructing something and a lot depends upon the user’s actual spatial understanding so that interpretation of the virtual world is translated into the real world –these technologies could have big appeal in disaster management areas to keep personnel safe and secure while performing rescue ops.

7. Democratization of Space

Multiple technical advances are creating the infrastructure for the sharing economy in space. Two prominent ones are: Reusable rockets and small and nano sats.

Any Tintin fan would know Herge had talked about rockets coming back to earth even before the first flight to space. The Adventures of Tintin and Explorers on Moon talks about a rocket that goes to Moon and comes back on Earth. Even a few years back, a rocket coming back on Earth and landing perfectly was pure fantasy or science fiction.

But today, Elon Musk has not only made that reality, but will make space travel costs less than what it takes to buy a penthouse in New York City! Others like Jezz Bezos’s Blue origin and Richard Branson’s Virgin Galactic are also working on reusable rockets and cheaper space travels. Bezos recently compared the advent of reusable rockets to the Internet and the national highway system, opening the door to an explosion of commercial space activity.

Small and nano satellites

Nano satellites, which are dramatically smaller, lighter and cheap, use common standards and off-the-shelf parts. Their weight and size brings in ease of launch: of ISRO’s record launch of 104 satellites in Feb, 88 were small sats from Planet. A higher number of satellites all around Earth means greater data frequency and high-revisit rates. Nano sats are a rage and in addition to private companies, national space agencies like NASA. ESA, ISRO and even big EO companies like DigitalGlobe are exploring small satellites. NASA last year launched CYGNSS – a small sat constellation to track hurricanes.

The small and nano sat industry has transformed satellite manufacturing from crafting one-off designs to mass assembly of standard products. The increasing intelligence of satellites and the communication bandwidth between them will allow them to operate as autonomous swarms, allocating monitoring or signal relay work to the satellite that can do it most efficiently. Finally, all these advances mean more and more space-based sensing and connectivity services with continual increases in image resolution and the area satellites can cover at lower cost.

How they will benefit

Satellites and systems that need their services can now autonomously negotiate and complete transactions based on predetermined criteria such as the price a customer is willing to pay for a certain image and how quickly they need it. A sharing economy in space means the distributed ownership of space assets and the data and communication services they produce. In this economy, satellites and their “products” would not only be owned by for-profit entities and governments, but by non-profit community groups, NGOs and individuals. This new economic model could provide much more accessible, faster and lower cost remote sensor data, as well as low-cost universal broadband communications for previously underserved areas and remote machines.

8. Rise of the Crowd

Smartphones in every hand has led to ever-increasing amount of spatially located information. No wonder UNGGIM recognized crowd sourcing as one of the most significant trends of coming times in their report last year.

Crowd-sourced information can be classified into two: Unintentional data generators on social media; and committed crowd sourcing workers.

Unintentional data generators

Users of social media such as Twitter and Facebook are likely to generate vast amounts of spatially‐related information. When you tweet from a place where you have gathered with friends or post a picture on Facebook from your phone, you may not be consciously creating geospatial information, but this is still, in essence, what is taking place.

In addition to an exponential increase in availability of real-time, geo-referenced information, it offers newer opportunities for location‐based service providers to further detect patterns and behavior prediction.

Committed crowd sourcing

Google Maps’s much popular traffic updates are also totally owing to power of the crowd. Today, maps are being generated using informal social networks and Web 2.0 technology. Anybody with location-enabled smartphones or tablets, cameras, or on-board sensor maps can contribute, resulting in an unprecedented potential for large-scale geospatial data collection.

How crowd sourcing can help?

Crowd sourcing can help in a number of critical situations like in case of disasters or epidemics.

Disaster management: Use of crowd sourcing information during disasters is well known. OpenStreetMaps was instrumental in aiding the near real time crisis mapping of the 2010 Haitian earthquake. The free, collaborative, editable map of the world paved the way for several non-governmental organizations to join forces with international firms.

Epidemics: National Geospatial Agency collaborated with Digital Globe, Esri and OSM to aid disaster relief agencies in their response to the Ebola epidemic in Western Africa in 2014. At the time of the Nepal earthquake, DigitalGlobe made its high-resolution satellite imagery available online for volunteers to tag damaged buildings, roads, and other areas which has witnessed massive destruction. For this, DigitalGlobe’s Tomnod crowdsourcing platform was used. This platform was also activated to locate the missing Malaysia Airlines Boeing 777 jetliner in 2014.

The real money is in private sector

This is especially true for the retail and BFSI companies who want to use the geographic location data for customer segmentation and customer profile analysis. Next step will be to go beyond content creation, toward content curation. Workers will be scanning social networks for already existing content which can fulfill their need.

9. Wearables

At the FIFA World Cup finals, Argentina and Germany were locked in a goal-less draw till the 88th minute. Pressed for time, German coach Joachim Low, decided to get in Mario Gotze into the game. Gotze went on score the only goal of the match to help Germany win its fourth World Cup. Now why did Low pick up a 22-year-old first timer over his other options on the bench? Wearable technology played a crucial role in that decision. Many don’t know that leading up to the World Cup, the German team wore wearable devices during the practise sessions to monitor everything from speed, distance, and heart rate of each player. The data collected was analyzed to see how exactly each athlete performed at what time of the match. This information was then used to plan future strategies.

Where wearables?

Wearable computing devices have long been integral part of connected soldier systems that provide a tactical advantage and improve troop safety. In the field of sports and fitness, wearables like fitness trackers and, more recently, smart watches have received a lot of attention and are in high demand. Beyond security, among the first ones to take to wearables was health care, providing workers and hospitals with savings opportunities. In cases of memory issues, the technology is seen so pathbreaking that US Justice Department in 2014 said it would cover cost of GPS tracking devices for kids with severe autism and other similar condition. The global Alzheimer’s Association has for long been advocating GPS trackers for elderlies with memory issues.

Outside the fitness and health care, applications such as entertainment and multimedia, and garments and fashion are majorly considered under the scope of the consumer electronics vertical. And of course there is navigation. A number of companies have launched devices such as smart helmets which uses augmented reality for navigation and allows the user ease of driving.

To wear or not…

Though there is a temporary lull in the market and demand for smartwatches has cooled as consumers wait for better functionality. But market prospects look very bright. The wearables market is set to treble in size in the next five years and become worth over $25 billion, according to industry analyst firm CCS Insight. A Gartner study predicted that 30% of wearable technology will be “unobtrusive to the naked eye” by 2017 – a trend we are seeing with the smart jacket from Googleand Levis.

Lower price points, better functionality, and expanded use cases show there is a vast potential for accelerated global growth. Moreover, because of the low adoption rate thus far, there is still ample opportunity for new entrants to join the market, and capture mind share. Wearables is a technology whose time is yet to come.